What is investment Fraud?

This is where people are persuaded / induced to make investment decisions and where the money invested is used for purposes not intended or where there is no business opportunity at all. The investor is deceive into investing in something which is misrepresented. There are generally promises of fast enormous returns, it’s a once in a lifetime opportunity, includes hard aggressive selling and can be seen to be endorsed by reputable business people and / or celebrities but this is without their knowledge.

This is not high risk investments or where legitimate investment schemes fail. In most cases there is no business opportunity, the entity is not registered nor does it exist. If registered it is registered well outside Ireland and even the EU.

Examples can include:

• Investment vehicles where funds are used for purposes not agreed by the investor

• Investment in property / funds / projects / business which do not exist

• Investment in crypto currencies

• Theft of funds invested genuine companies by staff or used by staff for personal gain

• Ponzi schemes

• Pyramid schemes

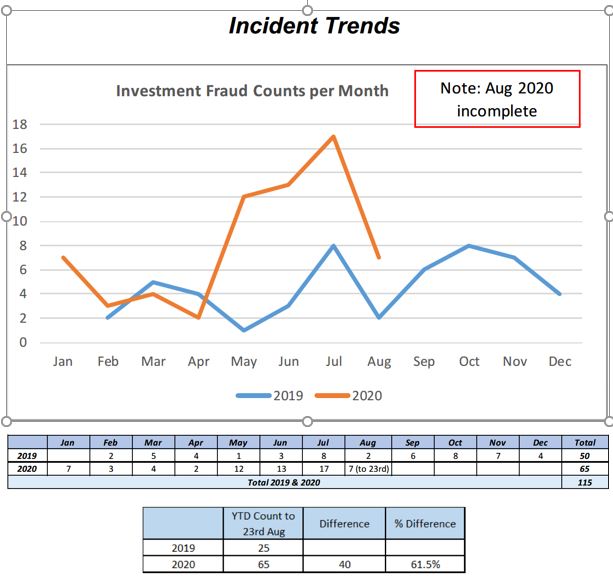

Gardaí across Ireland are seeing an increase in reports of investment fraud. In the first 8 months of 2020, there is approx. a 61.5% increase in reports. The vast majority of these involve crypto currencies – but this type of crime is believed to be under reported due to embarrassment, not wanting family to know, a knowledge that the money is gone and sometimes a hope being held out that the investment will come good in the end.

EG of a fake add

These IPs are spread all over the country.

Connacht = 11

Ulster – 3

Munster – 17

Leinster – 15

DMR - 18

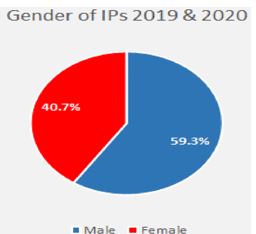

59.3% of victims are male and 40.7% are female

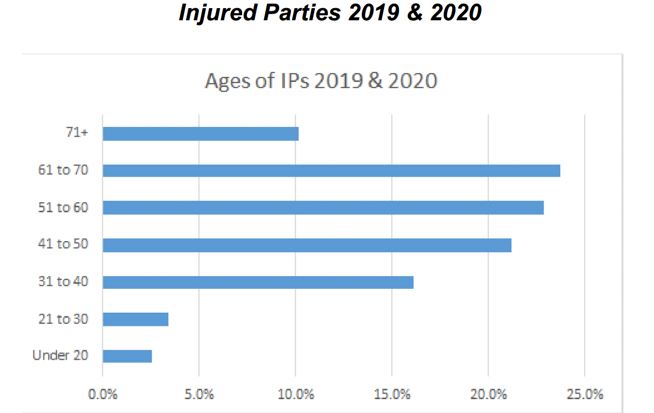

10% are over 70

24% are 61 – 70

23% are 51 – 60

21% are 41 – 50

16% are 31 – 40

6% are under 30

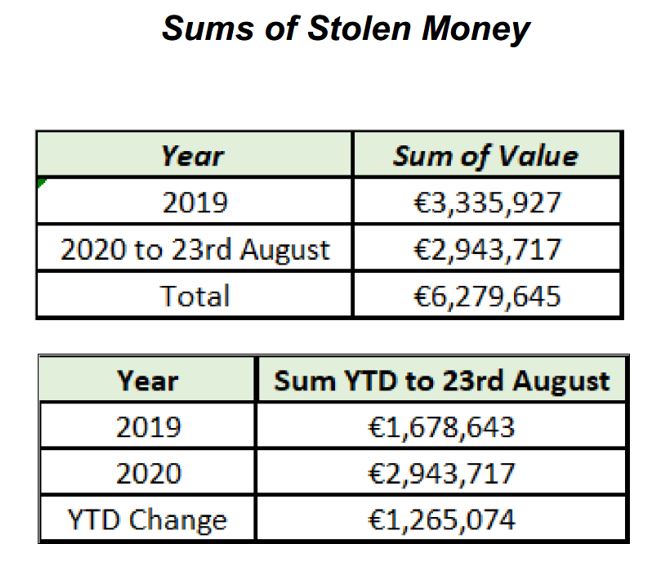

It is estimated that in the 8 month period (1/1/20 – 29/8/20) approximately €3 million (€2,943,717) has been reported as stolen. In all of 2019 there was €3,335,927 stolen. It is projected that at least €4.5m will be reported stolen this year – an increase of 35%.

An analysis of these reports indicate that in many of the cases, the victim was duped into investing into what they believed to be bitcoin or some other crypro currency. Almost all these victims either saw a pop up add or having some searches themselves on investments entered their contact details onto sites

Some of these fraudsters have websites and purport to be regulated in other jurisdictions. Some of the pop-up adds pop off when on legitimate sites, thus leading the person to believe they are genuine. Some lead the IP to believe that celebrities / famous business people are endorsing them (when they are not)

The victim is contacted by a person almost immediately upon them entering their phone numbers in contact boxes on the websites and in some cases, on the advice of the caller they downloaded links which allowed the caller take control of their computer. In many cases the caller persuaded the IPs to give over log in details and pins and gave control of their bank a/c to the caller. Once the money is transferred or once the IP asks difficult questions, contact is broke off. The callers are aggressive sales persons and offer once in a lifetime opportunity which MUST BE TAKEN NOW

Open sources checks on the names of the ‘companies’ the IPs ‘invested in’ immediately raise red flags. Terms like ‘the reputation of this broker is doubtful’ or ‘at best it is an unregulated broker’

Key signs to watch out for with investment scams

- The victim is cold called, i.e. they receive a telephone call out of the blue or receive an e-mail or are contacted via social media about a great investment opportunity.

- The victim is rushed and pressured into making a decision there and then, with no opportunity or time to consider the investment opportunity.

- There is a promise of a quick and profitable return on the investment with little or no risk.

- If the victim does some research on the company name and see terms like ‘the reputation of this broker is doubtful’ or ‘at best it is an unregulated broker’ then caution should be taken and the victim should walk away

Advice to the public

- Always seek independent financial and legal advice before making any investments and heed this advice

- Don’t respond to POP-UP adds, social media adds / contacts

- Don’t follow links from POP-UP adds or from social media or unsolicited emails/messages or other communications from persons unknown

- Don’t respond to cold calls

- Be wary of unsolicited emails / texts / calls / offers / advices

- Be wary where the investment is being endorsed by celebrities / famous business people – they may not know their name is attached to the advertisement

- Never ever give away your banking codes, pins, passwords, or any other personal data

- Don’t download suggested APPS and never allow another take control of your computer

- Only use regulated entities. All Financial Services Providers which hold an authorisation from the Central Bank of Ireland (‘Central Bank’), or where applicable, the SSM (the Single Supervisory Mechanism – European Central Bank), to provide financial services in Ireland are listed in the Central Bank Registers section. Prior to entering into a financial services transaction, members of the public can check the regulatory status of the firm they are dealing with

- Investors need to be aware that if they deal with unregulated firms they will not have access to the following protections:

-Investor compensation schemes

-The services of the Financial Services Ombudsman

- The Directors and senior management of unregulated firms are not subject to the Fitness and Probity Regime

- Unregulated firms are not subject to prudential requirements such as regulatory capital requirements or safeguarding of client funds

- Ensure you are on a real site and not a cloned / fake site – make sure the site is HTTPS secured – this is no guarantee that the site is genuine but it’s a start

- Do research on crypto currencies before making any investments – there are many different types

- Watch out for fake wallets - wallets are primarily about storing your cryptocurrency and not buying or selling it. Fake wallets can be scams for malware to infect your computer to steal your passwords and other personal information

- Look at the company you are thinking of investing in – do your research – do google searches – see if any warnings / media articles – check where is the company registered / regulated – Always check the central bank website

- Only invest what you can afford to lose. No investment return in 100% guaranteed.

- Be VERY wary of advertisements offering very high ‘too good to be true’ returns.

- Remember investing in crypto currency is high risk – most will fail

- Crypto currencies are virtual – if you lose your private key they are unrecoverable

- Virtual currencies are not regulated, so if something does go wrong you will not be able to claim compensation – YOU HAVE NO CONSUMER PROTECTION

- If you get a good offer – stop and consider – why me? why am I getting this once in a life time offer? why the rush?

- Be wary where there is a sense of urgency – has to be done now / last chance / etc /etc - don’t allow yourself to be rushed into it

- The Central Bank of Ireland advices that investing in cryptocurrency is unsuitable for most consumers particularly those pursuing long-term goals like saving for retirement

REMEMBER IF IT SOUNDS TOO GOOD TO BE TRUE THEN IT PROBABLY IS

Detective Chief Superintendent Pat Lordan and Detective Superintendent Michael Cryan briefing the media today on the dangers of Investment Fraud:

Further information on investment and other fraud types can be found on the FraudSMART website www.fraudSMART.ie

Further information on investment and other fraud types can be found on the FraudSMART website www.fraudSMART.ie

Examples of cases

Case no 1

IP was contacted via Instagram – conversation moved to whatsapp

Persuaded to enter a websites and invest in stock – IP lost €4000 over course of 5 transactions

It was a website that allowed you convert money into cryptocurrency and then send the cryptocurrency to another a/c

Trying to track the account holder who received the money via the website

Case no 2

IP was online when a pop up add appeared. Purported to be Irish Times and a leading Irish Politican praising advantages of investing in cryptocurrency. A link appeared and IP followed the link. Entered his number and immediately got a call from ‘financial advisor’. Over course of numerous conversation with this male and his ‘supervisor’ IP lost €3000. Went into bank account in Russia

Case no 3

IP saw a pop add while reading Irish Independent. She provided a phone number and was contacted by a UK looking number. She granted the caller remote access to her computer and she initially lost €255 and luckily her bank noticed unusual activity on her account and blocked €5,500 (all that was in her account) being transferred

Case no 4

IP saw a pop add and entered his contact details. Contacted by phone and email and was pursauded to download a link he received via email which allowed the fraudster take control of his computer. IP lost over €30,000. Money was transferred to eastern Europe. IP of the emails is in China. The phone number IP was contacted on are VOIP numbers

Case no 5

IP who is involved in business was in contact with a man they ‘met’ over the internet. IP was pursauded to invest in man’s business. IP lost over €120,000. IP was kept being told that if they reached a certain target of investment, they would receive a larger return on their investment

Case no 6

IP found a website when he was seeking investment opportunities. He was contacted and persuaded to start making investments in shares and stocks. In total IP ‘invested’ just over €20,000. Now transpired he was on a fake / cloned website

Case no 7

IP was investing in an online company buying cryptocurrency. She ‘invested’ a considerable sum of money (over €375,000) and was being send reports saying her deposits were growing and she was making profits and thus she invested more. When she tried to cash it out realised there was no money at all. Money went to a cryptocurrency exchange. The ‘company’ she invested in is described as an ‘unlicensed CFD investment Broker’